Error message preceding document N830 NCTS phase 5

Publication date 22-01-2025, 11:42

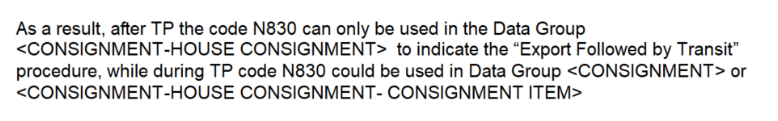

After the transition phase (from January 21, 2025), the preceding document N830 has been moved from code list 214 to code list 228.

This means that this document can no longer be used at consignment level, but only at house consignment level.

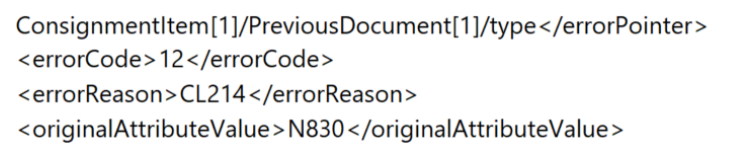

If you use the preceding document N830 at consignment level, you will receive the following error message:

The solution is to place this specific preceding document at house consignment level. All other preceding documents can still be used at consignment level.

Yesterday afternoon, DG TAXUD provided the following explanation:

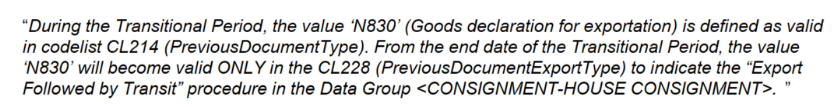

To align CS/RD2 with the provision of DDNTA-5.15.2, more specifically with the new G0991, that stated:

The following changes have been applied in CS/RD2 with validity date 21.01.2025:

The code N830 “Goods declaration for exportation” has been removed from the NCTS-P5 applicability of CL214 (PreviousDocumentType).

It is still available for AES applicability. The code N830 has been added to CL228 (PreviousDocumentExportType).

The changes were applied with validity date 21.01.2024.